Stockholders Equity Balance Sheet Guide, Examples, Calculation

Since they represent a company’s remainder of earnings not paid out in dividends, they are often referred to as retained surplus. The statement of retained earnings is also known as a statement of owner’s equity, an equity statement, or a statement of shareholders’ equity. Boilerplate templates of the statement of retained earnings can be found online. It is prepared in accordance with generally accepted accounting principles (GAAP). Retained earnings are important for the assessment of the financial health of a company.

What Is the Difference Between Retained Earnings and Dividends?

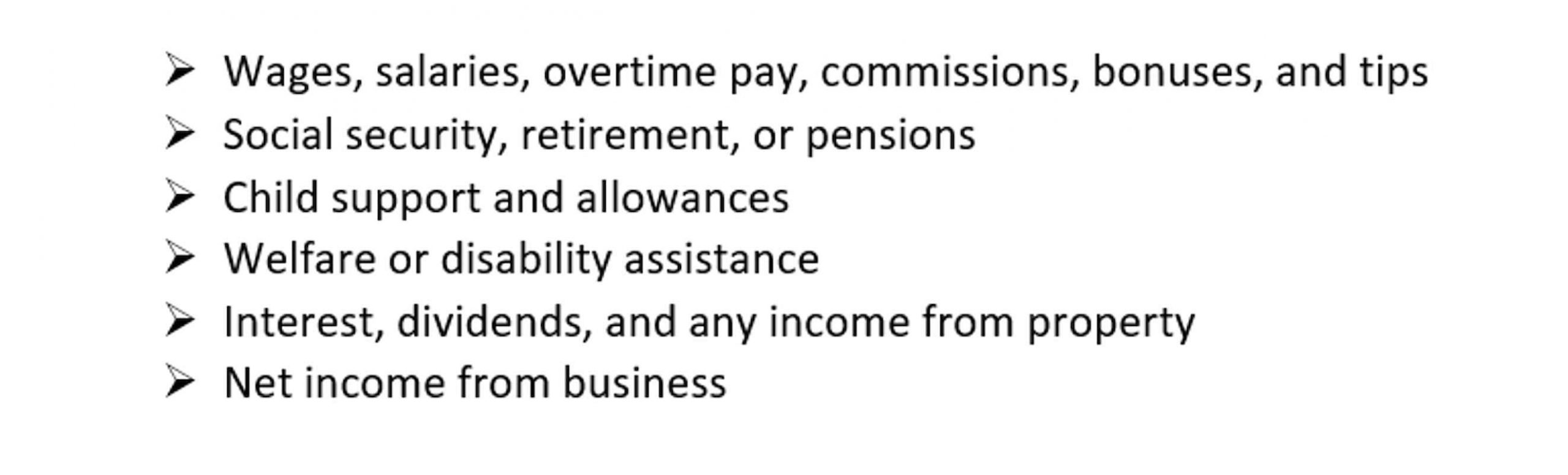

Retained earnings are also called earnings surplus and represent reserve money, which is available to company management for reinvesting back into the business. When expressed as a percentage of total earnings, it is also called the retention ratio and is equal to (1 – the dividend payout ratio). However, unlike retained earnings, revenue is reported as an asset on the balance sheet. When you subtract net expenses (including operating expenses) from revenue, you get net income, which is a key part of the retained earnings calculation. Your retained earnings balance is $105,000, and you can decide if you want to reinvest that money and/or pay off debts with it. Business owners should use a multi-step income statement that also separates the cost of goods sold (COGS) from operating expenses.

What Are Retained Earnings on a Balance Sheet?

A statement of retained earnings is a comprehensive summary of retained earnings and their calculation. Because the retained earnings are available for investments and expenditures, how they are spent is entirely up to the company. Total liabilities are the sum of all balance-sheet liabilities, both current and fixed (long-term). Accounts payable, taxes payable, bonds payable, leases, and pension obligations are all included.

Benefits of a Statement of Retained Earnings

Accordingly, there is significant overlap between the risk-management factors examiners review when rating a bank, and the types of issues an engaged bank management team should be considering as part of the planning process. The text box illustrates this https://www.bookstime.com/ idea in the context of how examiners rate the quality of earnings. None of this discussion should be taken to suggest that the FDIC expects elaborate, consultant-driven strategic planning documents every time a small bank wants to try something new.

Are Retained Earnings Current Liabilities or Assets?

Another important area of strategic focus is the response to the historically low interest rate environment and preparedness for potential future increases in interest rates. The interest rate environment has been challenging for small banks’ earnings during the post-crisis period and poses strategic challenges for bank management teams going forward. This article starts with an informal perspective on strategic planning and concludes by discussing strategic planning in the context of issues bank boards and managements are dealing with today. Strategic planning is a specific aspect of corporate governance that is of particular interest given the significant business decisions banks need to make regarding loan growth, asset-liability management, and other matters. The discussion is intended to provide food for thought, but should not be viewed as supervisory guidance.

- If the company makes cash sales, a company’s balance sheet reflects higher cash balances.

- The decision to retain earnings or to distribute them among shareholders is usually left to the company management.

- Because RE is calculated to date, they accumulate from one period to the next.

- Your retained earnings balance is $105,000, and you can decide if you want to reinvest that money and/or pay off debts with it.

- Retained earnings refer to the total net income or loss the company has accumulated over its lifetime (after dividend payouts are subtracted).

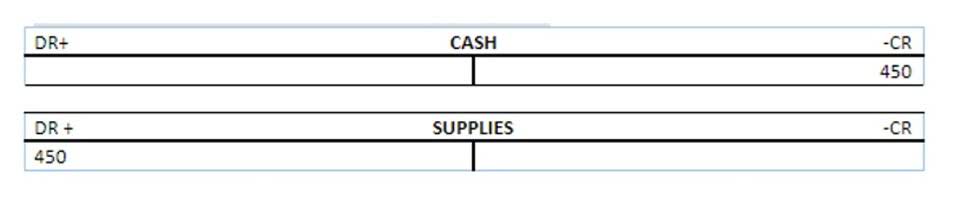

Paying the dividends in cash causes cash outflow, which we note in the accounts and books as net reductions. You calculate retained earnings by combining the balance sheet and income statement information. For an example, let’s look at a hypothetical hair product company that makes $15 million in sales revenue. Most financial statements have an entire section for calculating retained earnings. But small business owners often place a retained earnings calculation on their income statement.

Where Are Retained Earnings Located in Financial Statements?

It may also be directly reduced by capital awarded to shareholders through dividends. Therefore, while the scope of revenue is more narrow, the impact to retained earnings is much more far-reaching. The difference between total assets and total liabilities on the stockholders’ equity statement is usually measured monthly, quarterly, or annually.

You have beginning retained earnings of $12,000 and a net loss of $36,000. Companies in a growth phase tend to reinvest more of their surplus into the business, whereas a mature company may opt to pay more dividends when it has a surplus. Let’s say, for example, you own a construction company, and you want to invest in profit-producing activities using your retained earnings account. The goal is to maintain a balance that supports your business’s health and strategic goals while meeting shareholder expectations. Businesses take on expenses to generate more revenue, and net income is the difference between revenue (inflow) and expenses (outflow). Expenses are grouped toward the bottom of the income statement, and net income (bottom line) is on the last line of the statement.

The increase in lending is a welcome development that in broad terms signals ongoing recovery from the crisis. It is appropriate that small banks contribute to this recovery and benefit from the opportunities it creates. At the same time, it is especially important for banks entering new areas of lending or considering significant expansion plans to do this pursuant to a prudent, retained earnings asset or liabilities diligently executed strategy. The business focus of many small banks on real estate lending, a lending sector whose performance has been highly cyclical, underscores the importance of prudent risk management of lending activities. At the end of that period, the net income (or net loss) at that point is transferred from the Profit and Loss Account to the retained earnings account.

What Is Retained Earnings on Balance Sheet?

If dividends are granted, they are generally given out after the company pays all of its other obligations, so retained earnings are what is left after expenses and distributions are paid. Positive shareholder equity indicates that the company’s assets exceed its liabilities, whereas negative shareholder equity suggests that its liabilities exceed its assets. This is cause for concern because it marks the value of a company after investors and stockholders have been paid. Dividends paid to shareholders are entirely at the company’s discretion.